A debit note is a commercial document that records a transaction in which the seller reduces the amount owed by the buyer. It’s commonly used to correct errors, adjust prices, or provide discounts on goods or services.

Debit notes play a vital role in accounting and finance, ensuring accurate record-keeping and facilitating smooth business transactions. They help businesses address discrepancies efficiently, maintain customer satisfaction, and comply with financial regulations. Notably, the introduction of electronic document management systems has streamlined the processing and issuance of debit notes, enhancing their convenience and accessibility.

This article delves into the format of debit notes in Microsoft Word, providing a comprehensive guide to creating and using these documents effectively.

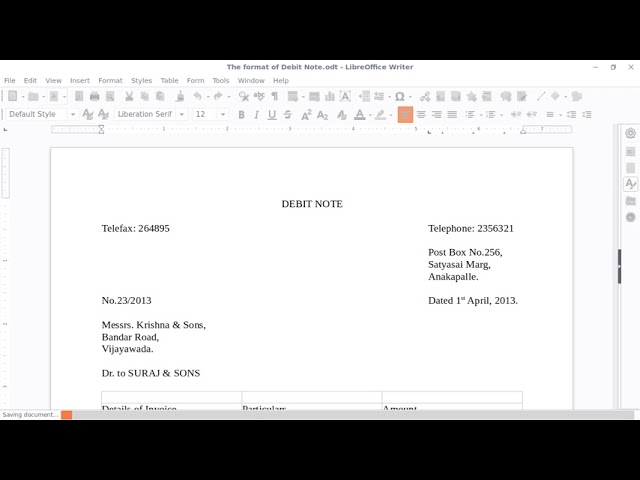

Debit Note Format in MS Word

Key aspects of debit note format in MS Word are crucial for ensuring accuracy, efficiency, and compliance in financial transactions.

- Header: Company details, debit note number, date

- Vendor Information: Name, address, contact details

- Customer Information: Name, address, contact details

- Invoice Reference: Original invoice number and date

- Reason for Debit Note: Correction, discount, adjustment

- Itemized Details: Description of goods/services, quantity, unit price

- Total Amount: Total amount of debit note

- Tax Details: Applicables and amounts

- Authorization: Signature or electronic approval

These elements ensure that debit notes are properly documented, traceable, and legally compliant. They facilitate clear communication between businesses, enabling efficient resolution of discrepancies and maintenance of accurate financial records.

Header: Company details, debit note number, date

The header of a debit note in MS Word holds significant importance. It establishes the document’s identity, ensures its validity, and facilitates efficient processing.

-

Company details:

The header should prominently display the company’s name, address, and contact information. This establishes the sender of the debit note and provides recipients with a clear point of reference. -

Debit note number:

Each debit note should have a unique identifying number. This number helps in tracking and referencing the document for accounting purposes and dispute resolution. -

Date:

The date on the header indicates when the debit note was issued. It serves as a timestamp for the transaction and ensures proper chronological ordering of financial records.

Collectively, these header elements create a standardized format for debit notes in MS Word. They streamline communication between businesses, minimize errors, and enhance the overall efficiency of financial transactions.

Vendor Information: Name, Address, Contact Details

In the context of debit note formats in Microsoft Word, vendor information plays a critical role. It establishes the sender of the debit note and provides essential contact details for communication and record-keeping.

The vendor’s name, address, and contact details create a clear and auditable record of the transaction. This information enables the recipient to identify the supplier, verify the authenticity of the debit note, and initiate any necessary follow-up actions.

Real-life examples of vendor information in debit note formats include:

- Company Letterhead: Many businesses use pre-printed letterheads that include the vendor’s name, address, and contact details.

- Dedicated Section: Some debit note templates in MS Word have a dedicated section for vendor information, ensuring its visibility and accessibility.

- Electronic Formats: In electronic debit note systems, vendor information is typically embedded in the document’s metadata or digital signature.

Understanding the connection between vendor information and debit note formats is crucial for accurate and efficient financial transactions. It facilitates proper communication, reduces errors, and ensures compliance with accounting standards.

Customer Information: Name, address, contact details

In the context of debit note formats in Microsoft Word, customer information holds paramount importance. It establishes the recipient of the debit note and facilitates effective communication, accurate record-keeping, and streamlined financial transactions.

The customer’s name, address, and contact details create a clear and auditable record of the transaction. This information enables the supplier to identify the buyer, verify the validity of the debit note, and initiate any necessary follow-up actions. Real-life examples of customer information in debit note formats include:

- Preprinted Forms: Many businesses use preprinted debit note forms that include dedicated fields for customer information.

- Digital Templates: Debit note templates in MS Word often have designated sections for customer details, ensuring their visibility and accessibility.

- Electronic Systems: In electronic debit note systems, customer information is typically embedded in the document’s metadata or digital signature.

Understanding the connection between customer information and debit note formats is crucial for accurate and efficient financial transactions. It facilitates proper communication, reduces errors, and ensures compliance with accounting standards. Furthermore, it enables businesses to maintain strong customer relationships by providing clear and easily accessible contact information.

Invoice Reference: Original invoice number and date

In the context of “debit note format in MS Word,” the “Invoice Reference” section plays a crucial role in establishing the connection between the debit note and the original invoice it corrects or adjusts. It comprises two key elements: the original invoice number and its date of issuance.

-

Invoice Number:

The original invoice number uniquely identifies the invoice being corrected or adjusted. It serves as a reference point for cross-checking and reconciliation purposes, ensuring proper matching between the debit note and the original transaction. -

Invoice Date:

The original invoice date indicates the date on which the original invoice was issued. It provides context for the debit note and helps in understanding the timeline of the transaction. This information is particularly useful in cases where there is a delay between the issuance of the original invoice and the subsequent debit note.

Comprehensively including the “Invoice Reference” section in debit note formats promotes transparency, accuracy, and efficient record-keeping. It facilitates seamless communication between businesses, minimizes errors, and ensures compliance with accounting standards. Moreover, it enables auditors and tax authorities to easily trace and verify the underlying transactions, enhancing the reliability and credibility of financial records.

Reason for Debit Note: Correction, discount, adjustment

The “Reason for Debit Note” section in a debit note format in MS Word plays a critical role in clarifying the purpose and intent of the document. It documents the underlying reason for issuing the debit note, which can vary depending on the circumstances and business practices.

-

Correction:

A debit note may be issued to correct errors or omissions on an original invoice. This could involve adjusting quantities, unit prices, or calculations, ensuring accuracy and completeness of financial records. -

Discount:

Debit notes can also be used to provide discounts or rebates to customers. This may occur due to promotional offers, volume purchases, or as a goodwill gesture. Clearly stating the discount reason helps maintain transparency and avoid confusion. -

Adjustment:

Adjustments to the original invoice amount may be necessary due to changes in product specifications, delivery terms, or payment conditions. Debit notes serve as a formal record of such adjustments, ensuring that both parties are aware of any modifications to the original agreement. -

Other:

In addition to the primary reasons mentioned above, debit notes may also be issued for various other purposes, such as reversing accruals, adjusting prepayments, or correcting tax calculations. Specifying the reason in the debit note format allows for proper interpretation and accounting treatment.

Clearly indicating the “Reason for Debit Note” is essential for proper documentation, audit trails, and maintaining accurate financial records. It facilitates efficient communication between businesses, minimizes errors, and ensures compliance with accounting standards. Moreover, it provides a clear understanding of the purpose of the debit note, enabling informed decision-making and smooth resolution of any discrepancies.

Itemized Details: Description of goods/services, quantity, unit price

In the context of “debit note format in MS Word,” the “Itemized Details” section holds immense significance in capturing the essential components of a business transaction. It provides a clear and comprehensive breakdown of the goods or services rendered, their respective quantities, and the applicable unit prices.

The inclusion of “Itemized Details” is crucial for several reasons. Firstly, it serves as a precise record of the transaction, ensuring accuracy and transparency. By itemizing each element, businesses can avoid errors and discrepancies, which can lead to disputes or financial losses. Secondly, it facilitates efficient accounting and reconciliation processes. The clear presentation of quantities and unit prices enables accountants to quickly verify and match the details against the original invoice or purchase order, streamlining the overall workflow.

Real-life examples of “Itemized Details” within “debit note format in MS Word” include:

- In the case of a sales return, the debit note would list the specific products being returned, their quantities, and the original unit prices.

- For a price adjustment, the debit note would detail the modified unit prices and the revised total amount.

Understanding the connection between “Itemized Details” and “debit note format in MS Word” is essential for businesses to maintain accurate financial records, ensure compliance with accounting standards, and facilitate smooth communication between parties involved in a transaction. By providing a granular level of detail, businesses can effectively manage their finances, minimize errors, and maintain strong business relationships.

Total Amount: Total amount of debit note

In the realm of “debit note format in MS Word,” the “Total Amount” holds a significant place, representing the crux of the financial transaction being documented. It captures the cumulative value of the adjusted or corrected invoice, providing a concise summary of the monetary impact. The “Total Amount” serves as a critical component of the debit note format, acting as a central reference point for both the supplier and the customer.

The “Total Amount” directly reflects the adjustments or corrections being made to the original invoice. Whether it involves rectifying errors, offering discounts, or adjusting prices, the “Total Amount” accurately reflects the net change in the financial obligation. Its presence ensures transparency and clarity in the transaction, minimizing confusion and disputes.

Real-life examples of the “Total Amount” within “debit note format in MS Word” abound. In the case of a sales return, the debit note would display the total value of the returned goods, calculated by multiplying the quantity returned by the agreed-upon unit price. Conversely, for a price adjustment, the debit note would reflect the revised total amount, incorporating the new unit prices and recalculated totals.

Understanding the connection between ” Total Amount: Total amount of debit note” and “debit note format in ms word” is essential for businesses to maintain accurate financial records and facilitate efficient accounting processes. By accurately capturing the total amount of the adjustment or correction, businesses can effectively manage their cash flow, minimize errors, and maintain strong financial discipline.

Tax Details: Applicable s and amounts

Within the context of “debit note format in MS Word,” Tax Details play a crucial role in ensuring the accuracy and completeness of financial transactions. They capture information related to applicable taxes, rates, and amounts, providing a clear record of tax implications and adjustments.

-

Tax Type:

This section specifies the type of tax being applied to the transaction, such as Goods and Services Tax (GST), Value Added Tax (VAT), or any other relevant tax. -

Tax Rate:

The applicable tax rate is clearly stated, indicating the percentage or fixed amount of tax levied on the goods or services. -

Tax Amount:

The calculated tax amount is displayed, representing the monetary value of the tax applicable to the transaction. -

Tax Exemptions:

In cases where exemptions or reductions apply, this section details the specific exemptions or discounts granted, along with any supporting documentation or references.

Understanding the significance of “Tax Details: Applicable s and amounts” in “debit note format in MS Word” is essential for businesses to maintain compliance with tax regulations, ensure accurate financial reporting, and avoid potential penalties or disputes. Proper documentation of tax information facilitates efficient tax audits, reduces the risk of errors, and enhances the overall credibility of financial records.

Authorization: Signature or electronic approval

Within the framework of “debit note format in ms word,” the aspect of ” Authorization: Signature or electronic approval” holds significant importance, ensuring the validity, authenticity, and accountability of debit notes. It serves as a formal acknowledgment of the adjustments or corrections being made to an original invoice.

-

Authorized Signatory:

The debit note typically requires the signature of an authorized representative from the supplier or vendor. This signature serves as an indication that the individual has the authority to approve and issue the debit note on behalf of the company. -

Electronic Approval:

In modern business practices, electronic signatures or digital certificates are increasingly used as a means of authorizing debit notes. This method provides a secure and convenient way to approve and issue debit notes electronically, reducing the need for physical signatures and expediting the approval process. -

Legal Implications:

The presence of an authorized signature or electronic approval on a debit note carries legal weight and serves as evidence of the supplier’s acknowledgment of the adjustments or corrections being made. It helps to minimize disputes and ensures the enforceability of the debit note. -

Accountability and Audit Trail:

The authorization process creates a clear audit trail, establishing a record of who approved and issued the debit note. This information is crucial for internal control purposes, ensuring accountability and facilitating investigations in case of any discrepancies or irregularities.

In summary, the ” Authorization: Signature or electronic approval” in “debit note format in ms word” plays a critical role in establishing the authenticity, validity, and accountability of debit notes. It ensures proper authorization and approval of adjustments or corrections to original invoices, minimizing errors, disputes, and potential legal ramifications.

Debit Note Format in MS Word FAQs

This section addresses frequently asked questions and clarifies aspects related to “debit note format in MS Word” to enhance understanding and proper implementation.

Question 1: What are the essential elements of a debit note format in MS Word?

Answer: A debit note in MS Word typically includes header information, vendor and customer details, invoice reference, reason for issuance, itemized details, total amount, tax details, and authorization.

Question 2: How do I ensure the accuracy of a debit note?

Answer: Carefully review all information, including quantities, unit prices, calculations, and tax details. Verify against the original invoice and supporting documentation to minimize errors and discrepancies.

Question 3: Is it mandatory to have an authorized signature or electronic approval on a debit note?

Answer: Yes, authorization is crucial for validity and accountability. It indicates the supplier’s acknowledgment of the adjustments or corrections being made.

Question 4: Can debit notes be used for purposes other than correcting errors?

Answer: Yes, debit notes can also be used for providing discounts, adjusting prices, or reversing accruals, among other reasons.

Question 5: How do I handle tax calculations in a debit note?

Answer: Clearly specify the applicable tax rates and amounts in the tax details section. Ensure compliance with relevant tax regulations and consult professional advice if necessary.

Question 6: What are the benefits of using a standardized debit note format in MS Word?

Answer: Standardization ensures consistency, accuracy, and efficient processing of debit notes. It facilitates clear communication, minimizes errors, and enhances overall financial record-keeping.

These FAQs provide essential guidance on “debit note format in MS Word,” clarifying common concerns and promoting effective implementation. Understanding these aspects contributes to accurate and compliant financial transactions.

In the following section, we will delve into best practices for creating and issuing debit notes in MS Word, further enhancing your understanding and practical application of this valuable document.

Tips for Creating and Issuing Debit Notes in MS Word

This section provides practical tips to enhance the creation and issuance of debit notes in MS Word, ensuring accuracy, efficiency, and compliance.

Tip 1: Use a standardized template: Utilize pre-formatted debit note templates to ensure consistency and minimize errors.

Tip 2: Verify accuracy: Carefully review all details, including quantities, unit prices, calculations, and tax information, to prevent errors.

Tip 3: Obtain proper authorization: Secure the signature or electronic approval of an authorized representative to validate the debit note.

Tip 4: Specify the reason clearly: State the purpose of the debit note concisely, whether it’s for error correction, discount, or price adjustment.

Tip 5: Maintain clear records: Keep copies of all issued debit notes for audit purposes and future reference.

Tip 6: Use electronic systems: Consider using electronic debit note systems to streamline the process, reduce errors, and enhance efficiency.

Tip 7: Seek professional advice: Consult with accounting or legal professionals if you have complex transactions or require guidance on specific regulations.

By following these tips, businesses can effectively create and issue debit notes in MS Word, ensuring accuracy, compliance, and efficient financial management.

In the concluding section, we will discuss advanced applications of debit notes in managing business transactions and maintaining financial records.

Conclusion

This comprehensive exploration of “debit note format in ms word” has elucidated its significance in financial transactions and accounting processes. Debit notes serve as crucial tools for rectifying errors, adjusting prices, and providing discounts, ensuring accurate record-keeping and smooth business operations.

Key insights from this article include the importance of using a standardized format to ensure consistency and minimize errors. The authorization process, involving signatures or electronic approvals, establishes accountability and validity. It is essential to maintain clear records for audit purposes and future reference, as debit notes provide a detailed trail of adjustments made to original invoices.

Understanding the proper format and utilization of debit notes empowers businesses to manage their finances efficiently, maintain compliance with regulations, and foster transparent relationships with customers. Embracing best practices and leveraging technology can further enhance the effectiveness and accuracy of debit note processing.