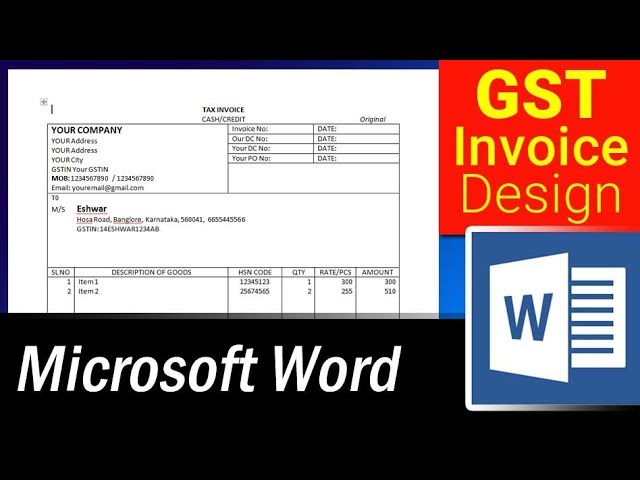

A GST tax invoice format in Word download is a standard document used for billing and accounting purposes under the Goods and Services Tax (GST) regime. It is a structured template that includes essential information such as the supplier’s and recipient’s details, invoice number, date, description of goods or services, quantity, unit price, total amount, GST rate, and the total GST payable. This format ensures compliance with GST regulations and facilitates seamless transactions.

GST tax invoice formats play a crucial role in GST-related documentation. They provide a clear and organized record of transactions, ensuring accuracy and transparency. They also enable businesses to claim input tax credits, which is a significant benefit of the GST system. The introduction of GST in India in 2017 brought about a major transformation in the country’s taxation landscape, and GST tax invoice formats have been an integral part of this change.

This article will delve deeper into the GST tax invoice format in Word, providing a comprehensive guide to its structure, requirements, and best practices. We will also discuss the benefits and legal implications of using standardized GST tax invoices. By understanding the intricacies of GST tax invoice formats, businesses can ensure compliance, streamline their accounting processes, and reap the full benefits of the GST system.

GST Tax Invoice Format in Word Download

GST tax invoice formats are essential for businesses to comply with GST regulations and ensure accurate documentation of transactions. Understanding the key aspects of these formats enables businesses to effectively manage their GST-related processes.

- Supplier Details

- Recipient Details

- Invoice Number

- Invoice Date

- Description of Goods/Services

- Quantity

- Unit Price

- Total Amount

- GST Rate

- Total GST Payable

These aspects provide a comprehensive framework for recording GST-related transactions. Supplier and recipient details ensure clear identification of parties involved. Invoice number and date maintain a chronological record of transactions. Description, quantity, and unit price capture the details of goods or services supplied. Total amount and GST rate determine the GST liability. Total GST payable is the final GST amount to be remitted to the government. Understanding these aspects helps businesses maintain accurate GST records, claim input tax credits, and avoid penalties for non-compliance.

Supplier Details

In the context of GST tax invoice formats in Word download, supplier details play a crucial role in ensuring the accuracy and validity of transactions. They provide clear identification of the party providing the goods or services, facilitating seamless communication and record-keeping.

- Business Name and Address: The legal name and registered address of the supplier must be clearly stated. This information helps identify the supplier and their location, ensuring transparency in business dealings.

- GSTIN (Goods and Services Tax Identification Number): The supplier’s unique GSTIN is mandatory and must be prominently displayed on the invoice. It serves as proof of GST registration and enables the recipient to verify the supplier’s authenticity and claim input tax credits.

- Contact Information: The supplier’s contact details, including phone number, email address, and website (if any), should be provided. This information allows for easy communication and follow-up between the supplier and recipient.

- Bank Account Details: The supplier’s bank account details, including account number, IFSC code, and bank name, are necessary for the recipient to make payments. Accurate bank details ensure timely and secure transactions.

Complete and accurate supplier details on GST tax invoices are essential for maintaining proper accounting records, claiming input tax credits, and ensuring compliance with GST regulations. They form the foundation for transparent and efficient business transactions.

Recipient Details

Recipient details are an essential component of GST tax invoice formats in Word download, providing crucial information about the party receiving the goods or services. Accurate and complete recipient details ensure smooth transactions, proper record-keeping, and compliance with GST regulations.

- Business Name and Address: The legal name and registered address of the recipient must be clearly stated. This information helps identify the recipient, their location, and their business entity.

- GSTIN (Goods and Services Tax Identification Number): The recipient’s unique GSTIN is mandatory and must be prominently displayed on the invoice. It enables the supplier to verify the recipient’s GST registration status and claim input tax credits.

- Contact Information: The recipient’s contact details, including phone number, email address, and website (if any), should be provided. This information allows for easy communication and follow-up between the supplier and recipient.

- Place of Supply: The place of supply is the location where the goods or services are received by the recipient. This information is crucial for determining the applicable GST rate and ensuring compliance with GST regulations.

Complete and accurate recipient details on GST tax invoices are essential for maintaining proper accounting records, claiming input tax credits, and ensuring compliance with GST regulations. They form the foundation for transparent and efficient business transactions.

Invoice Number

Within the comprehensive structure of “gst tax invoice format in word download”, the “Invoice Number” holds a significant position, serving as a unique identifier for each transaction. It plays a crucial role in maintaining organized records, tracking payments, and ensuring compliance with GST regulations.

- Uniqueness: Each invoice number must be unique, allowing for easy identification and retrieval of specific invoices. This uniqueness ensures the integrity of transactions and simplifies accounting processes.

- Sequential Order: Invoice numbers are typically assigned sequentially, providing a chronological record of transactions. This sequential order aids in maintaining a systematic flow of invoices and simplifies the tracking of payments.

- Internal Reference: Invoice numbers serve as internal references for businesses, enabling them to cross-reference invoices with other accounting documents, such as purchase orders and delivery challans. This internal referencing enhances the efficiency of accounting operations.

- External Communication: Invoice numbers are often used for external communication, such as when businesses share invoices with customers or suppliers. The invoice number facilitates easy identification and tracking of transactions between different parties.

In summary, the “Invoice Number” in “gst tax invoice format in word download” plays a multifaceted role. It ensures the uniqueness and sequential order of invoices, serves as an internal reference for businesses, and facilitates external communication. Understanding the significance of these aspects empowers businesses to maintain accurate records, streamline accounting processes, and adhere to GST compliance requirements.

Invoice Date

Within the framework of “gst tax invoice format in word download,” the “Invoice Date” assumes great significance. It serves as a critical component, fulfilling both legal and practical purposes. The invoice date establishes the point in time when the transaction takes place, triggering a series of important effects.

Primarily, the invoice date determines the tax liability associated with the transaction. Under GST regulations, the tax liability arises on the date of supply of goods or services. The invoice date serves as documented proof of this supply, enabling businesses to accurately calculate and pay their GST dues.

Furthermore, the invoice date plays a crucial role in managing cash flow and payment terms. It sets the starting point for payment due dates and helps businesses track their accounts receivable. Accurate invoice dates ensure timely payments and prevent unnecessary delays or disputes.

In conclusion, the “Invoice Date” holds immense importance within the “gst tax invoice format in word download.” It establishes the tax liability, facilitates cash flow management, and serves as a vital reference point for accounting and auditing purposes. Understanding the significance of the invoice date empowers businesses to maintain compliance, optimize their financial operations, and make informed decisions.

Description of Goods/Services

Within the framework of “gst tax invoice format in word download,” the “Description of Goods/Services” holds immense significance. It serves as a comprehensive and accurate representation of the transaction, providing vital details that impact various aspects of GST compliance and accounting.

- Itemized Listing: The description should clearly list each individual item or service supplied, capturing specific details such as quantity, unit of measurement, and any distinguishing characteristics.

- Nature of Transaction: It should concisely describe the nature of the transaction, whether it involves the sale of goods, provision of services, or a combination of both.

- HSN/SAC Code: The Harmonized System of Nomenclature (HSN) code or Service Accounting Code (SAC) must be specified for each item or service. This categorization is crucial for determining the applicable GST rate and ensuring compliance.

- Brand and Model: If applicable, the description should include the brand and model of the goods supplied. This level of detail is especially important for items with varying specifications or tax implications.

Overall, the “Description of Goods/Services” in “gst tax invoice format in word download” serves as a critical component that facilitates accurate tax calculations, ensures compliance with GST regulations, and provides a clear record of the transaction for both the supplier and the recipient.

Quantity

Within the framework of “gst tax invoice format in word download,” the “Quantity” field holds significant importance in ensuring accurate GST calculation and compliance. It represents the number of units of goods or services supplied in the transaction and directly impacts the total taxable value.

The quantity is a critical component of the GST tax invoice format as it serves as the basis for calculating the total amount chargeable under GST. In cases where the goods or services are sold in units, the quantity field must accurately reflect the number of units supplied. Incorrect or missing quantity information can lead to errors in GST calculations, resulting in potential penalties or disputes.

Real-life examples of quantity within the GST tax invoice format include the number of items purchased, the weight of goods sold in kilograms, or the duration of services provided in hours. It is essential to provide accurate quantity information to ensure that the GST liability is correctly calculated and reported.

Understanding the connection between quantity and the GST tax invoice format is crucial for businesses to maintain compliance and avoid penalties. Proper recording of quantity ensures accurate GST calculations, facilitates GST return filing, and provides a clear audit trail for tax authorities. It also enables businesses to optimize their inventory management and track the movement of goods or services effectively.

Unit Price

Within the framework of “gst tax invoice format in word download,” the “Unit Price” holds immense significance in determining the total taxable value of goods or services supplied. It represents the price per unit of the item or service, directly impacting the GST liability and various other aspects of the transaction.

The unit price is a critical component of the GST tax invoice format as it serves as the basis for calculating the total amount chargeable under GST. Accurate and consistent unit prices are essential to ensure that the GST liability is correctly calculated and reported. Incorrect or missing unit price information can lead to errors in GST calculations, resulting in potential penalties or disputes.

Real-life examples of unit price within the GST tax invoice format include the price per kilogram for goods sold by weight, the price per hour for services rendered, or the price per piece for individual items purchased. It is crucial to provide accurate unit price information to ensure that the GST liability is correctly calculated and reported.

Understanding the connection between unit price and the GST tax invoice format is crucial for businesses to maintain compliance and avoid penalties. Proper recording of unit price ensures accurate GST calculations, facilitates GST return filing, and provides a clear audit trail for tax authorities. It also enables businesses to optimize their pricing strategies, track profitability, and make informed decisions regarding inventory management.

Total Amount

Within the framework of “gst tax invoice format in word download,” the “Total Amount” holds significant importance as the summation of all taxable values charged for the goods or services supplied. It is a critical component that directly influences the calculation of GST liability and other financial aspects of the transaction.

The Total Amount serves as the base for GST calculation. Accurate and consistent recording of the Total Amount ensures correct determination of GST liability, avoiding potential errors or disputes. It also serves as a key factor in managing cash flow and making informed business decisions.

Real-life examples of the Total Amount within the GST tax invoice format include the total value of goods sold before applying any discounts or taxes. It represents the gross amount chargeable to the customer and is used to calculate the total GST payable.

Understanding the connection between the Total Amount and the GST tax invoice format is crucial for businesses to maintain compliance, optimize financial operations, and make informed decisions. It enables effective cash flow management, accurate GST reporting, and efficient inventory tracking. By accurately recording the Total Amount, businesses can streamline their accounting processes, minimize errors, and maintain a clear audit trail.

GST Rate

Within the framework of “gst tax invoice format in word download,” the “GST Rate” holds immense significance as the percentage levied on the taxable value of goods or services supplied. It is a critical component that directly influences the calculation of GST liability and other financial aspects of the transaction.

The GST Rate serves as a multiplier to the Total Amount, determining the GST payable on the transaction. Accurate and consistent application of the correct GST Rate ensures compliance with tax regulations and avoids potential penalties or disputes. It is essential to refer to the GST Rate Schedule notified by the government to determine the applicable GST Rate for each item or service supplied.

Real-life examples of the GST Rate within the “gst tax invoice format in word download” include the 5% GST Rate applicable to essential commodities like milk and bread, the 12% GST Rate applicable to processed food items, and the 18% GST Rate applicable to most goods and services. Understanding the connection between the GST Rate and the GST tax invoice format is crucial for businesses to maintain compliance, optimize financial operations, and make informed decisions.

By accurately applying the GST Rate and recording it on the GST tax invoice, businesses can streamline their accounting processes, minimize errors, and maintain a clear audit trail. It enables effective cash flow management, accurate GST reporting, and efficient inventory tracking. Proper understanding and application of the GST Rate ensure that businesses fulfill their GST obligations, avoid legal complications, and maintain a competitive edge in the market.

Total GST Payable

Within the framework of “gst tax invoice format in word download,” the “Total GST Payable” holds immense significance as the final amount of GST liability calculated on the transaction. It represents the total GST payable to the government and directly influences various financial and compliance aspects of the business.

The Total GST Payable is a critical component of “gst tax invoice format in word download” as it serves as the basis for determining the GST liability. Accurate and consistent calculation of the Total GST Payable ensures compliance with tax regulations, avoids potential penalties or disputes, and provides a clear understanding of the tax liability associated with the transaction.

Real-life examples of “Total GST Payable” within “gst tax invoice format in word download” include the calculation of GST payable on the sale of goods or services rendered. The Total GST Payable is calculated by applying the applicable GST Rate to the Total Amount and is presented in a separate section of the invoice. Understanding the connection between the Total GST Payable and “gst tax invoice format in word download” is crucial for businesses to maintain compliance, optimize financial operations, and make informed decisions.

Practical applications of this understanding include efficient cash flow management, accurate GST reporting, and effective inventory tracking. By accurately calculating and recording the Total GST Payable, businesses can streamline their accounting processes, minimize errors, and maintain a clear audit trail. It enables businesses to fulfill their GST obligations, avoid legal complications, and maintain a competitive edge in the market.

Frequently Asked Questions (FAQs) on GST Tax Invoice Format in Word Download

This FAQ section aims to address commonly asked questions and clarify key aspects of GST tax invoice formats in Word. These questions anticipate queries that readers may have while understanding and utilizing this format.

Question 1: What are the essential components of a GST tax invoice format?

Answer: A GST tax invoice must include details such as supplier and recipient information, invoice number and date, description of goods/services, quantity, unit price, total amount, GST rate, and total GST payable.

Question 2: Why is it important to use the standardized GST tax invoice format?

Answer: The standardized format ensures compliance with GST regulations, simplifies accounting processes, facilitates input tax credit claims, and maintains transparency.

Question 3: Where can I download the GST tax invoice format in Word?

Answer: You can download the GST tax invoice format in Word from the official website of the GST portal.

Question 4: What are the consequences of issuing incorrect or incomplete GST tax invoices?

Answer: Issuing incorrect or incomplete invoices can lead to penalties, legal complications, and reputational damage.

Question 5: How can I ensure the accuracy and validity of my GST tax invoices?

Answer: Regularly review and verify invoice details, maintain proper accounting records, and seek professional assistance if needed.

Question 6: What are the benefits of using GST tax invoice formats in my business?

Answer: Using standardized GST tax invoice formats streamlines operations, reduces errors, simplifies compliance, and enhances the credibility of your business.

These FAQs provide essential insights into GST tax invoice formats in Word, addressing common concerns and clarifying the importance and usage of this format. Understanding these aspects empowers businesses to comply with GST regulations, optimize their financial processes, and maintain accurate accounting records.

In the next section, we will delve deeper into the legal implications of GST tax invoice formats and explore best practices for their implementation.

Tips for Using GST Tax Invoice Formats in Word

This section provides practical tips to assist businesses in effectively utilizing GST tax invoice formats in Word. By following these guidelines, businesses can ensure compliance, streamline operations, and maintain accurate accounting records.

Tip 1: Use the Latest Template:

Always download the most up-to-date GST tax invoice format from the official GST portal to incorporate the latest regulatory changes and avoid errors.

Tip 2: Fill in All Required Details:

Ensure that all mandatory fields in the invoice format are accurately and completely filled in to maintain compliance and facilitate smooth processing.

Tip 3: Verify Supplier and Recipient Information:

Double-check the accuracy of supplier and recipient details, including names, addresses, and GSTINs, to avoid confusion and ensure proper record-keeping.

Tip 4: Calculate GST Correctly:

Meticulously calculate GST based on the applicable GST rate and taxable value to ensure accurate tax liability and avoid penalties.

Tip 5: Maintain a Consistent Format:

Adhere to the standardized GST tax invoice format to ensure uniformity, simplify accounting processes, and enhance the credibility of your business.

Tip 6: Keep Digital Records:

Maintain digital copies of GST tax invoices for easy retrieval, efficient record-keeping, and seamless audits.

Tip 7: Seek Professional Guidance:

Consult with a tax professional or GST expert if you encounter any complexities or have questions regarding GST tax invoice formats to ensure compliance and avoid mistakes.

Tip 8: Regularly Review and Update:

Periodically review your GST tax invoice practices and update them based on regulatory changes or best practices to maintain accuracy and efficiency.

Following these tips empowers businesses to leverage GST tax invoice formats effectively, ensuring compliance, streamlining operations, and maintaining accurate accounting records. By adhering to these guidelines, businesses can minimize errors, enhance transparency, and optimize their GST-related processes.

In the concluding section, we will explore additional strategies for GST compliance and discuss the benefits of implementing these best practices.

Conclusion

In summary, understanding and implementing GST tax invoice formats in Word is crucial for businesses to comply with GST regulations, streamline accounting processes, and maintain accurate records. This article has explored the key aspects of GST tax invoice formats, their legal implications, and best practices for their implementation.

The article highlights the importance of using standardized formats, ensuring accuracy and completeness of invoice details, and seeking professional guidance when needed. By following the tips and guidelines outlined in this article, businesses can ensure that their GST tax invoices are compliant, efficient, and support their overall GST compliance strategy.