An invoice format in Word 2003 is a structured template used to create invoices, which are essential documents that itemize the goods or services provided to a customer and the amount owed. It serves as a record of the transaction and facilitates efficient billing and payment processes.

This format is highly relevant for businesses and freelancers who need to manage their invoicing professionally. It provides a consistent and organized layout, ensuring that invoices are clear, accurate, and legally compliant. Historically, invoice formats have evolved to include more detailed information, such as payment terms, tax calculations, and customer contact details.

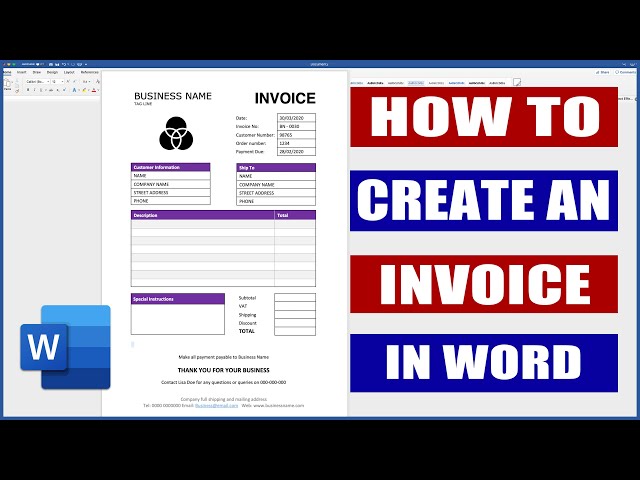

This article will guide you through the essential components and customization options of an invoice format in Word 2003, enabling you to create professional invoices that meet your business requirements.

Invoice Format in Word 2003

When creating an invoice format in Word 2003, it is essential to consider the following key aspects to ensure a professional and effective document:

- Company Information

- Customer Information

- Invoice Number

- Invoice Date

- Due Date

- Itemized List of Goods/Services

- Quantity and Price

- Subtotal

- Taxes

- Total Amount

These aspects are interconnected and play crucial roles in the functionality of an invoice. For instance, the company and customer information establishes the parties involved in the transaction, while the invoice number and date serve as unique identifiers and legal records. The itemized list of goods/services, quantity, and price provide a detailed breakdown of the charges, ensuring clarity and accuracy. Subtotal, taxes, and total amount calculations guarantee precise billing and compliance with tax regulations. By considering these key aspects and customizing the invoice format accordingly, businesses can create professional and legally compliant invoices that facilitate smooth billing and payment processes.

Company Information

Company Information is a crucial aspect of an invoice format in Word 2003 as it establishes the identity of the business providing the goods or services and facilitates communication between the parties involved in the transaction. It typically includes the company name, address, contact details, and other relevant information.

-

Company Name

The legal name of the business or organization issuing the invoice. -

Business Address

The physical or registered address of the company, including street address, city, state, and zip code. -

Contact Details

Phone number, email address, and website of the company, allowing customers to reach out for inquiries or support. -

Tax Identification Number (TIN)

A unique identifier assigned by the tax authorities, necessary for tax reporting and compliance.

Complete and accurate Company Information on an invoice ensures clear identification of the sender, facilitates communication, and enhances the credibility and professionalism of the document. It also serves as a legal record of the transaction and helps establish trust between the parties involved.

Customer Information

Customer Information plays a pivotal role in an invoice format in Word 2003, as it establishes the recipient of the invoice and facilitates effective communication and record-keeping. Without accurate and complete Customer Information, the invoice may lack credibility and legal validity, potentially leading to payment delays or disputes. Conversely, a well-structured invoice format with comprehensive Customer Information ensures clear identification of the customer, efficient billing processes, and enhanced customer satisfaction.

Real-life examples of Customer Information in an invoice format in Word 2003 include:

- Customer Name: The legal name or business name of the individual or organization receiving the invoice.

- Billing Address: The address where the invoice and any related correspondence should be sent.

- Contact Details: Phone number, email address, and website of the customer, allowing for easy communication and support.

- Customer Reference Number: A unique identifier assigned by the customer for their internal record-keeping and reference.

Understanding the connection between Customer Information and invoice format in Word 2003 has several practical applications. Firstly, it enables businesses to create professional and legally compliant invoices that are easily identifiable and verifiable by customers. Secondly, it facilitates efficient billing and payment processes, reducing errors and delays. Thirdly, it enhances customer satisfaction by providing clear and accurate information, fostering trust and loyalty.

In conclusion, Customer Information is a critical component of an invoice format in Word 2003, establishing the recipient of the invoice, ensuring effective communication, and enhancing the overall efficiency and credibility of the billing process.

Invoice Number

Invoice Number holds a central position within the invoice format in Word 2003, serving as a unique identifier that streamlines billing processes, prevents errors, and enhances the overall efficiency of invoice management. Its significance stems from the need to distinguish each invoice from others, ensuring clear identification and error-free processing. Without a unique invoice number, invoices may become easily confused or misplaced, leading to payment delays, disputes, and potential legal complications.

Real-life examples of Invoice Numbers in an invoice format in Word 2003 include a sequential numeric system, alphanumeric codes, or a combination of both. The choice of format depends on the specific needs and preferences of the business. Regardless of the format, the Invoice Number should be prominently displayed on the invoice, typically in the header section, to facilitate easy identification and retrieval.

Understanding the connection between Invoice Number and invoice format in Word 2003 has several practical applications. Firstly, it enables businesses to maintain organized and accurate invoice records, reducing the risk of errors and disputes. Secondly, it streamlines the payment process by allowing customers to quickly identify and reference specific invoices, ensuring timely payments. Thirdly, it simplifies accounting and bookkeeping tasks, making it easier to track income, expenses, and outstanding balances.

In summary, Invoice Number is an indispensable component of an invoice format in Word 2003. Its unique identifying function ensures efficient invoice management, error prevention, and streamlined payment processing. Understanding the connection between Invoice Number and invoice format is essential for businesses seeking to optimize their billing processes and maintain accurate financial records.

Invoice Date

Within the broader scope of “invoice format in word 2003”, “Invoice Date” holds significance as a crucial element that serves multiple purposes. It not only indicates the date on which the invoice was issued, but also plays a vital role in legal and financial contexts. Exploring the various aspects of “Invoice Date” provides a deeper understanding of its importance within the invoice format.

-

Issuance Date

The Invoice Date primarily represents the date on which the invoice was created and issued to the customer. It serves as a timestamp that documents the initiation of the billing process.

-

Payment Terms

The Invoice Date serves as a reference point for determining the due date or payment terms specified on the invoice. It helps both the issuer and the customer understand the expected payment timeline.

-

Legal Implications

In certain legal contexts, the Invoice Date may be used to determine the validity of an invoice, particularly in cases of disputes or claims. It provides a documented record of the transaction’s occurrence.

-

Accounting and Finance

From an accounting and finance perspective, the Invoice Date is crucial for recording and tracking income and expenses accurately. It helps businesses maintain organized financial records and ensures proper revenue recognition.

In summary, “Invoice Date” is an integral part of the “invoice format in word 2003”. Its multifaceted nature encompasses issuance date, payment terms, legal implications, and accounting significance. Understanding these aspects provides businesses and individuals with a comprehensive view of the role and importance of “Invoice Date” in the context of invoice management and financial transactions.

Due Date

Within the context of “invoice format in word 2003”, “Due Date” holds significant importance as it directly impacts payment timelines, cash flow management, and customer relationships. Exploring the connection between these two elements provides valuable insights into the effective utilization of invoice formats.

As a critical component of “invoice format in word 2003”, “Due Date” specifies the date by which payment for the goods or services rendered is expected. It influences the customer’s perception of the business’s payment expectations and sets clear guidelines for timely payments. By establishing a specific due date, businesses can proactively manage their cash flow and avoid potential delays or disputes.

Real-life examples of “Due Date” within “invoice format in word 2003” often involve numerical representations, such as “Due within 30 days from the invoice date” or “Payment due by [specific date]”. These variations provide flexibility based on individual business practices and customer agreements.

Understanding the connection between “Due Date” and “invoice format in word 2003” has several practical applications. Firstly, it enables businesses to optimize their payment collection processes by setting clear expectations and encouraging timely payments. Secondly, it minimizes the risk of late payments and potential penalties, ensuring a steady cash flow. Thirdly, it enhances customer satisfaction by providing transparent payment terms and fostering a sense of accountability.

Itemized List of Goods/Services

In the context of “invoice format in word 2003”, the “Itemized List of Goods/Services” stands as a vital component that holds significant implications for businesses and customers alike. This section delves into the multifaceted aspects of “Itemized List of Goods/Services”, exploring its role, real-life examples, and effects within the broader framework of “invoice format in word 2003”.

-

Detailed Description

The “Itemized List of Goods/Services” provides a detailed breakdown of each item or service offered, including a clear description, quantity, and unit price. This level of granularity ensures transparency and accuracy in billing, enabling customers to verify the charges.

-

Tax Implications

“Itemized List of Goods/Services” plays a crucial role in determining tax calculations. By specifying the type and quantity of goods or services, businesses can correctly apply appropriate tax rates, ensuring compliance with tax regulations and avoiding errors.

-

Organized Presentation

A well-structured “Itemized List of Goods/Services” presents information in an organized and easy-to-understand manner. This clarity enhances the readability of the invoice, making it simpler for customers to review and process the charges.

-

Legal Documentation

The “Itemized List of Goods/Services” serves as legal documentation of the transaction between the business and the customer. It provides a detailed record of the goods or services provided, their prices, and any applicable taxes, which can be crucial in resolving disputes or ensuring legal compliance.

In conclusion, the “Itemized List of Goods/Services” is an integral part of “invoice format in word 2003”, contributing to accurate billing, proper tax calculations, organized presentation, and legal documentation. Its multifaceted nature underscores its importance in ensuring clarity, transparency, and efficiency in the invoicing process.

Quantity and Price

Within the context of “invoice format in word 2003”, “Quantity and Price” represent two critical components that directly influence the calculation of total charges and the accuracy of the invoice. Understanding their connection is essential for businesses seeking to create clear, accurate, and legally compliant invoices.

The “Quantity” field in an invoice format in Word 2003 indicates the number of units of a particular good or service being purchased. It plays a vital role in determining the total cost of each item and the overall invoice amount. The “Price” field, on the other hand, represents the cost of a single unit of the good or service. By multiplying the quantity by the price, businesses can calculate the total charge for each item listed on the invoice.

Real-life examples of “Quantity and Price” within an invoice format in Word 2003 include: “5 Widgets @ $10 per unit” or “10 Hours of Consulting @ $50 per hour.” These examples demonstrate how the quantity and price of each item are clearly specified, allowing customers to easily calculate the total cost of each service or product.

Understanding the connection between “Quantity and Price” and invoice format in Word 2003 has several practical applications. Firstly, it enables businesses to create accurate and transparent invoices that clearly outline the charges for goods or services rendered. Secondly, it ensures compliance with tax regulations by providing a detailed breakdown of the quantity and price of each item, facilitating accurate tax calculations. Thirdly, it helps businesses manage their inventory and pricing strategies by tracking the quantity of goods sold and the prices charged, allowing them to make informed decisions about future purchases and pricing adjustments.

Subtotal

Within the realm of invoice formatting in Word 2003, “Subtotal” holds a critical position, serving as an essential component that consolidates and summarizes the total charges for goods or services rendered before the application of taxes and discounts. Understanding the connection between “Subtotal” and “invoice format in word 2003” is vital for businesses seeking to create accurate, transparent, and legally compliant invoices.

The “Subtotal” in an invoice format in Word 2003 represents the sum of all charges for individual items or services listed on the invoice, excluding any taxes or discounts that may be applicable. It provides a concise overview of the total cost of the goods or services before these additional factors are taken into account. By calculating the subtotal accurately, businesses can ensure that the final invoice amount is correct and reflects the true value of the transaction.

Real-life examples of “Subtotal” within an invoice format in Word 2003 include: “Subtotal: $500” or “Subtotal: $1,000 (before tax).” These examples demonstrate the clear and concise presentation of the subtotal, allowing customers to quickly ascertain the total cost of the goods or services before taxes and discounts are applied.

Understanding the connection between “Subtotal” and “invoice format in word 2003” has several practical applications. Firstly, it enables businesses to create accurate and transparent invoices that clearly outline the charges for goods or services rendered. Secondly, it ensures compliance with tax regulations by providing a clear breakdown of the subtotal before taxes are applied, facilitating accurate tax calculations. Thirdly, it helps businesses manage their cash flow by providing a quick and easy way to estimate the total amount due before taxes and discounts are applied.

Taxes

Within the context of “invoice format in word 2003”, “Taxes” play a significant role, affecting the calculation of the total amount due and ensuring compliance with legal requirements. Understanding the various aspects of “Taxes” as they relate to “invoice format in word 2003” is essential for businesses seeking to create accurate, transparent, and legally compliant invoices.

-

Tax Rates

Tax rates vary depending on the jurisdiction and type of goods or services being sold. Businesses must apply the correct tax rates to each item listed on the invoice to ensure accurate calculations.

-

Tax Codes

Tax codes are used to identify the specific tax rates that apply to each item or service. Businesses must use the correct tax codes to ensure that the appropriate taxes are applied.

-

Tax Calculations

Tax calculations are performed by multiplying the subtotal by the applicable tax rate. Businesses must perform these calculations accurately to ensure that the correct amount of tax is charged.

Understanding the connection between “Taxes” and “invoice format in word 2003” has several practical applications. Firstly, it enables businesses to create accurate and transparent invoices that clearly outline the taxes charged. Secondly, it ensures compliance with tax regulations by providing a clear breakdown of the taxes applied, facilitating accurate tax reporting. Thirdly, it helps businesses manage their cash flow by providing a clear understanding of the total amount of taxes due.

Total Amount

In the realm of “invoice format in word 2003”, the “Total Amount” holds a position of critical importance, serving as the culmination of all charges, taxes, and discounts applied to the goods or services rendered. Understanding the intricate connection between “Total Amount” and “invoice format in word 2003” is paramount for businesses seeking to create accurate, transparent, and legally compliant invoices.

The “Total Amount” represents the final sum that the customer is obligated to pay for the goods or services purchased. It is calculated by taking the subtotal, adding any applicable taxes, and subtracting any discounts offered. Businesses must calculate the “Total Amount” accurately to ensure that they are charging the correct amount and to maintain customer trust.

Real-life examples of “Total Amount” within “invoice format in word 2003” include: “Total Amount: $1,000” or “Total Amount Due: $500.” These examples demonstrate the clear and concise presentation of the “Total Amount,” allowing customers to quickly ascertain the final cost of their purchase.

Understanding the connection between “Total Amount” and “invoice format in word 2003” has several practical applications. Firstly, it enables businesses to create accurate and transparent invoices that clearly outline the final amount due. Secondly, it ensures compliance with legal requirements by providing a clear breakdown of the total charges, taxes, and discounts applied. Thirdly, it helps businesses manage their cash flow by providing a clear understanding of the total amount of revenue generated from each invoice.

Frequently Asked Questions

This FAQ section addresses common queries and clarifies aspects of “invoice format in word 2003” to enhance your understanding and ensure efficient invoice creation.

Question 1: What are the essential components of an invoice format in Word 2003?

Answer: An invoice format typically includes company information, customer information, invoice number, invoice date, due date, itemized list of goods/services, quantity and price, subtotal, taxes, and total amount.

Question 2: How can I ensure the accuracy of my invoice calculations?

Answer: Carefully review the quantity, price, and tax calculations for each item. Use a calculator or spreadsheet to verify the subtotal, taxes, and total amount to avoid errors.

Question 3: What are tax codes and how do I use them correctly?

Answer: Tax codes identify the specific tax rates applicable to each item or service. Businesses must use the correct tax codes to ensure accurate tax calculations and compliance with tax regulations.

Question 4: Can I customize the invoice format to meet my specific business needs?

Answer: Yes, Word 2003 allows you to customize the invoice format by adding or removing fields, changing the layout, and incorporating your company logo or branding elements.

Question 5: How do I save my customized invoice format for future use?

Answer: Once you have created your customized invoice format, save it as a template in Word 2003. This will allow you to easily create new invoices using the same format.

Question 6: What are some best practices for creating professional invoices?

Answer: Use clear and concise language, organize the information logically, proofread carefully for accuracy, and ensure that your invoices are visually appealing and easy to understand.

These FAQs provide a comprehensive overview of essential aspects of invoice formatting in Word 2003. By addressing these common questions, we aim to empower businesses with the knowledge and skills to create accurate, professional, and legally compliant invoices.

In the next section, we will delve deeper into advanced invoice formatting techniques and explore how to create visually appealing and informative invoices that enhance your brand identity and improve customer satisfaction.

Tips for Creating Professional Invoices in Word 2003

This section provides practical tips and insights to help you create professional and effective invoices using Word 2003. By incorporating these tips into your invoicing process, you can enhance the clarity, accuracy, and overall quality of your invoices, leaving a positive impression on your customers.

Tip 1: Use a clear and consistent layout.

Organize your invoice in a logical and visually appealing manner. Maintain consistent spacing, fonts, and colors throughout the document to ensure readability and professionalism.

Tip 2: Include all essential information.

Ensure that your invoice includes all necessary details, such as your company information, customer information, invoice number, invoice date, due date, itemized list of goods/services, quantity and price, subtotal, taxes, and total amount.

Tip 3: Proofread carefully for accuracy.

Before sending out an invoice, carefully review it for any errors in calculations, spelling, or grammar. Accuracy is crucial for maintaining trust and credibility with your customers.

Tip 4: Use professional language and tone.

Maintain a professional tone throughout your invoice. Avoid using slang or overly casual language. Use clear and concise language that is easy for your customers to understand.

Tip 5: Consider using a template.

Creating an invoice template in Word 2003 can save you time and ensure consistency in your invoicing process. Templates allow you to easily fill in the necessary information and generate professional-looking invoices.

By following these tips, you can create invoices that are clear, accurate, and professional. This will not only enhance your brand image but also improve customer satisfaction and streamline your invoicing process.

In the concluding section of this article, we will discuss best practices for invoice management, including tips on organizing your invoices, tracking payments, and maintaining accurate financial records.

Conclusion

In exploring the intricacies of “invoice format in word 2003”, we have gained valuable insights into the essential components, best practices, and professional techniques involved in creating effective invoices. Understanding the significance of each element, from company information to payment terms, enables businesses to generate clear, accurate, and legally compliant invoices.

Key takeaways from our discussion include the importance of using a consistent and professional layout, including all necessary information, and proofreading carefully for accuracy. Additionally, leveraging invoice templates and maintaining organized financial records can streamline the invoicing process and ensure efficient cash flow management.