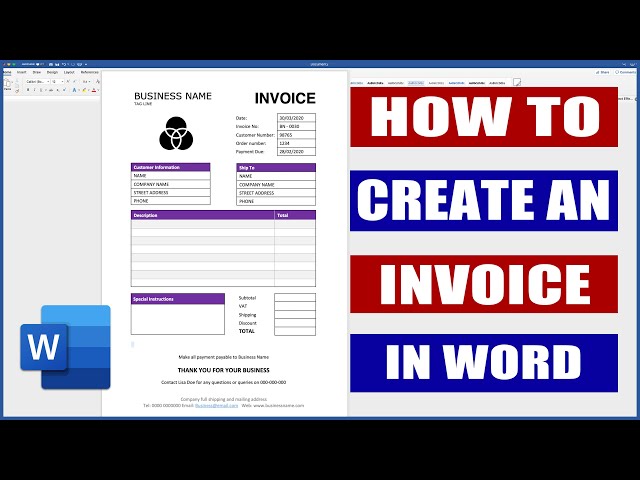

An invoice format in Word for a software company is a pre-designed template used to create invoices, which are essential for businesses to request payment for goods or services provided. It includes necessary details such as the invoice number, date, customer information, description of services, quantity, unit price, total amount, payment terms, and company contact details.

Using an invoice format specifically designed for software companies streamlines the invoicing process, ensuring accuracy and consistency. It also enhances professionalism and credibility, making it easier to track payments and manage cash flow. Historically, invoices were handwritten or typed using basic word processing software. However, today’s digital invoice formats offer advanced features such as automatic calculations, customizable templates, and seamless integration with accounting systems.

This article will delve into the essential elements of an invoice format in Word for software companies, discussing best practices for creating clear and effective invoices that meet industry standards and legal requirements.

Invoice Format in Word for Software Company

Defining the essential aspects of an invoice format in Word for a software company is crucial for creating clear, effective, and legally compliant invoices. These aspects encompass various dimensions related to the format, content, and functionality of the invoice.

- Company Information: Name, address, contact details

- Customer Information: Name, address, contact details

- Invoice Number: Unique identifier for each invoice

- Invoice Date: Date the invoice is issued

- Payment Terms: Due date, payment methods accepted

- Itemized Services: Description, quantity, unit price, total amount

- Subtotal: Total amount before taxes

- Taxes: Applicable taxes and their amounts

- Total Amount: Final amount due

- Notes: Additional information or instructions

These aspects are interconnected and contribute to the overall functionality and effectiveness of the invoice format. For instance, the company and customer information ensures proper identification and communication. Itemized services provide a clear breakdown of the goods or services provided, while payment terms establish the expectations for payment. Taxes and total amount calculations ensure accuracy and compliance with legal requirements. Notes can be used to convey important details or instructions related to the invoice.

Company Information

Within the context of an invoice format in Word for a software company, the section titled “Company Information” serves as the professional identity and contact point for the business issuing the invoice. It typically includes three key components: the company name, address, and contact details.

- Company Name: The official name of the software company, as registered with relevant authorities and recognized by customers.

- Company Address: The physical location or registered office address of the software company, providing a tangible connection for legal and correspondence purposes.

- Contact Details: This section typically includes a combination of contact methods such as phone number, email address, and website URL, enabling customers to reach the software company for inquiries, support, or payment-related matters.

Collectively, these elements establish the credibility and professionalism of the software company, allowing customers to easily identify the source of the invoice and contact them for any necessary communication or clarifications. By presenting clear and accurate company information, software companies can build trust and foster positive relationships with their customers.

Customer Information

Within the context of an invoice format in Word for a software company, the section titled “Customer Information” plays a crucial role in establishing a clear and direct connection with the recipient of the invoice. It serves as a vital means of communication, allowing software companies to effectively convey invoice details and facilitate prompt payment.

- Customer Name: The legal or official name of the individual or organization that has purchased the software products or services, ensuring proper identification and accurate record-keeping.

- Customer Address: The physical or registered address of the customer, providing a tangible connection for correspondence, legal purposes, and potential delivery of goods or services.

- Contact Details: This section typically includes a combination of contact methods such as phone number, email address, and website URL, enabling software companies to reach out to customers for inquiries, support, or payment-related matters.

Collectively, these elements facilitate effective communication between software companies and their customers, ensuring that invoices are delivered to the intended recipient, payments are processed efficiently, and any necessary clarifications or follow-ups can be addressed promptly. By presenting clear and accurate customer information, software companies can establish a foundation for positive and professional relationships with their valued customers.

Invoice Number

Within the context of “invoice format in word for software company”, the “Invoice Number” serves as a critical element, acting as a unique identifier for each invoice issued. This unique identifier plays a pivotal role in organizing, tracking, and referencing invoices, ensuring efficient management and retrieval of financial records.

- Sequential Numbering: Invoice numbers are typically assigned sequentially, starting from 1 and incrementing with each new invoice, providing a chronological order for easy referencing and tracking.

- Invoice Series: Some companies use invoice series to differentiate between different types of invoices or projects. For instance, they may have separate series for regular invoices, proforma invoices, or credit memos.

- Company Identifier: The invoice number may incorporate a prefix or suffix that represents the company’s unique identifier, enhancing recognition and preventing duplication across multiple entities.

- Date Inclusion: Some invoice numbering systems include the date or year in the invoice number, providing additional context and facilitating chronological organization.

Collectively, these facets of “Invoice Number: Unique identifier for each invoice” contribute to the overall functionality and organization of an invoice format in word for software companies. By employing a unique and sequential numbering system, companies can streamline their invoicing processes, minimize errors, and maintain accurate financial records.

Invoice Date

Within the context of “invoice format in word for software company”, the “Invoice Date” holds significant importance as a critical component that serves multiple purposes. It represents the date on which the invoice is issued and acts as a legal document for recording the transaction between the software company and its customer.

The “Invoice Date” plays a pivotal role in establishing the timeline for payment and determining any applicable early payment discounts or late payment penalties. It also serves as a reference point for accounting and auditing purposes, allowing companies to track their income and expenses accurately.

In real-life scenarios, the “Invoice Date” is typically displayed prominently on the invoice, often alongside the invoice number and customer information. It serves as a crucial piece of information for both the software company and the customer, ensuring clarity and transparency in the billing process.

Understanding the connection between “Invoice Date: Date the invoice is issued” and “invoice format in word for software company” is essential for maintaining accurate financial records, managing cash flow effectively, and complying with legal requirements. By incorporating the “Invoice Date” as a critical component of the invoice format, software companies can streamline their invoicing processes and foster better relationships with their customers.

Payment Terms

Within the context of “invoice format in word for software company”, “Payment Terms: Due date, payment methods accepted” plays a crucial role in establishing clear expectations and guidelines for invoice settlement. It encompasses two key aspects: the due date and the accepted payment methods.

-

Due Date:

The due date specifies the date by which the invoice payment is expected. It serves as a reference point for both the software company and the customer, ensuring timely payment and avoiding late payment penalties.

-

Payment Methods:

The accepted payment methods outline the options available to the customer for settling the invoice. This may include bank transfers, online payment platforms, credit cards, or even cash in some cases. Providing multiple payment options enhances convenience and flexibility for customers, increasing the likelihood of prompt payment.

Overall, clearly defined “Payment Terms: Due date, payment methods accepted” contribute to smoother financial transactions, reduced payment delays, and enhanced customer satisfaction. By incorporating these terms into their invoice format, software companies can streamline their invoicing processes, minimize administrative hassles, and maintain a positive cash flow.

Itemized Services

Within the context of “invoice format in word for software company”, “Itemized Services: Description, quantity, unit price, total amount” stands as a critical component that serves multiple purposes. It provides a detailed breakdown of the services rendered by the software company, capturing essential information for accurate billing and customer understanding.

Each aspect of “Itemized Services: Description, quantity, unit price, total amount” contributes to the overall effectiveness of the invoice format:

Description: Clearly outlines the nature of the services provided, ensuring transparency and reducing the risk of disputes.

Quantity: Specifies the number of units or hours associated with each service, providing a precise measurement of the work performed.

Unit Price: Indicates the agreed-upon price for each unit or hour of service, allowing for accurate calculation of the total amount due.

Total Amount: Represents the total cost for each itemized service, serving as the basis for calculating the overall invoice amount.

Collectively, these elements enable software companies to create invoices that are detailed, accurate, and legally compliant. By incorporating “Itemized Services: Description, quantity, unit price, total amount” into their invoice format, software companies can enhance transparency, streamline billing processes, and maintain strong customer relationships.

Subtotal

In the context of “invoice format in word for software company”, “Subtotal: Total amount before taxes” bears significant importance as it represents the sum of all charges for goods or services provided, excluding applicable taxes. This crucial component serves as the foundation for calculating the final invoice amount and plays a pivotal role in ensuring accurate billing.

The subtotal amount directly influences the calculation of taxes, which vary depending on the jurisdiction and type of goods or services being invoiced. By clearly displaying the subtotal, software companies enable customers to understand the pre-tax cost of their purchases, promoting transparency and reducing the risk of disputes.

In real-life scenarios, “Subtotal: Total amount before taxes” is typically presented as a separate line item on the invoice, positioned before the tax amount and total invoice amount. This placement allows customers to easily identify the pre-tax cost and calculate the total amount due, including taxes.

Understanding the connection between “Subtotal: Total amount before taxes” and “invoice format in word for software company” is essential for software companies to create invoices that are compliant with tax regulations and provide accurate information to customers. By incorporating this critical component into their invoice format, software companies can streamline their billing processes, enhance customer satisfaction, and maintain strong financial controls.

Taxes

In the context of “invoice format in word for software company”, “Taxes: Applicable taxes and their amounts” bears significant importance as it directly impacts the total amount due from the customer and plays a crucial role in ensuring compliance with tax regulations. This critical component involves identifying and calculating the applicable taxes based on the type of goods or services provided, as well as the jurisdiction in which the transaction takes place.

Software companies must accurately determine and include the correct taxes on their invoices to maintain legal compliance and avoid potential penalties. The invoice format should clearly display the tax rates and amounts, allowing customers to understand the breakdown of charges and the total cost of their purchase. Real-life examples include value-added tax (VAT) in Europe, sales tax in the United States, and goods and services tax (GST) in many other countries.

By incorporating “Taxes: Applicable taxes and their amounts” into their invoice format, software companies can ensure transparency, build trust with customers, and maintain strong financial controls. Customers appreciate the clarity and accuracy of invoices that clearly outline the tax charges, reducing the risk of disputes or misunderstandings. Moreover, adhering to tax regulations is essential for maintaining a positive reputation and avoiding legal consequences.

Total Amount

Within the context of “invoice format in word for software company”, “Total Amount: Final amount due” stands out as a critical component that directly influences the customer’s payment obligation and serves as the culmination of the invoice. It represents the total sum of all charges, including itemized services, subtotal, taxes, and any additional fees, providing a clear and concise summary of the amount owed.

The “Total Amount: Final amount due” acts as a pivotal element of the invoice format, as it determines the final payment expectation from the customer. It is typically displayed prominently on the invoice, often in a larger font or highlighted section, ensuring its visibility and importance. By presenting the “Total Amount: Final amount due” accurately and prominently, software companies can effectively communicate the payment obligation to customers, minimizing confusion or disputes.

In real-world scenarios, the “Total Amount: Final amount due” is crucial for various practical applications. It serves as the basis for payment processing, enabling customers to settle their invoices promptly and avoid late payment penalties. The “Total Amount: Final amount due” also plays a role in accounting and financial reporting, providing a clear record of income generated from software products or services. Furthermore, it helps businesses track their cash flow and make informed decisions regarding their financial performance.

Understanding the connection between “Total Amount: Final amount due” and “invoice format in word for software company” is essential for creating compliant and effective invoices. By incorporating this critical component into their invoice format, software companies can streamline their billing processes, enhance customer communication, and maintain accurate financial records. This understanding contributes to the overall efficiency and professionalism of software companies, fostering trust and positive relationships with their customers.

Notes

Within the context of “invoice format in word for software company”, “Notes: Additional information or instructions” serves as a critical component that provides a dedicated space for conveying supplementary information or specific instructions related to the invoice. It allows software companies to communicate important details beyond the standard invoice elements, enhancing clarity, and streamlining the billing process.

This section of the invoice format plays a crucial role in addressing various scenarios. For instance, a software company may use the “Notes” section to specify any special payment terms or discounts that are not included in the standard payment terms. Additionally, they can provide detailed instructions for software installation, activation, or usage, ensuring that customers have the necessary information to utilize the software effectively.

In real-life examples, “Notes: Additional information or instructions” can include guidance on technical support availability, warranty information, or references to user manuals or online resources. By incorporating these details into the invoice, software companies demonstrate their commitment to customer satisfaction and provide a comprehensive understanding of the products or services being invoiced.

Understanding the connection between “Notes: Additional information or instructions” and “invoice format in word for software company” is essential for creating informative and effective invoices. By utilizing this section strategically, software companies can enhance communication, minimize misunderstandings, and provide a positive customer experience. This understanding contributes to the overall professionalism and efficiency of software companies, fostering trust and strong relationships with their clients.

Frequently Asked Questions (FAQs) on Invoice Format for Software Company

This section addresses common queries and clarifies essential aspects of “invoice format in word for software company” to enhance understanding and address potential concerns.

Question 1: What are the key elements of an invoice format for a software company?

An effective invoice format typically includes company and customer information, invoice number, invoice date, payment terms, itemized services, subtotal, taxes, total amount, and notes for additional information.

Question 2: Why is it important to have a clear and consistent invoice format?

A standardized invoice format ensures accuracy, professionalism, and efficient processing. It minimizes errors, streamlines communication, and enhances customer satisfaction.

Question 3: What are some best practices for creating effective invoices?

Use clear language, provide detailed descriptions, include accurate calculations, and ensure timely delivery. Consider offering multiple payment options and providing a dedicated space for notes or instructions.

Question 4: How can software companies use invoice formats to improve their billing processes?

By automating invoice generation, integrating with accounting systems, and providing online payment portals, software companies can streamline their billing processes, reduce manual labor, and improve cash flow.

Question 5: What legal requirements should be considered when creating invoices?

Software companies must adhere to specific legal requirements, such as including business registration details, tax identification numbers, and clear payment terms. Failure to comply may result in penalties or legal consequences.

Question 6: How can invoice formats contribute to customer satisfaction?

Well-designed invoices provide clarity, transparency, and ease of payment. By addressing customer queries promptly and resolving disputes effectively, software companies can foster positive relationships and build customer loyalty.

These FAQs provide valuable insights into the significance and best practices of invoice formats for software companies. As we delve deeper into this topic, we will explore advanced techniques, industry-specific considerations, and strategies to optimize invoice processes for improved efficiency and customer satisfaction.

Tips for Creating Professional Invoices for Software Companies

To enhance the effectiveness of your invoice format, consider implementing the following practical tips:

Tip 1: Use clear and concise language: Ensure your invoices are easy to understand by using straightforward language and avoiding jargon or technical terms.

Tip 2: Provide detailed descriptions: Include specific details about the services or products provided, including quantity, unit price, and any applicable discounts.

Tip 3: Ensure accurate calculations: Double-check all calculations for accuracy, including subtotal, taxes, and total amount due.

Tip 4: Offer multiple payment options: Provide customers with various payment methods, such as bank transfer, credit card, or online payment portals.

Tip 5: Include clear payment terms: Specify the due date, payment methods accepted, and any applicable late payment fees.

Tip 6: Use automation tools: Consider using invoice automation software to streamline invoice generation, track payments, and send reminders.

Tip 7: Provide excellent customer support: Be responsive to customer inquiries, address disputes promptly, and offer support if needed.

By implementing these tips, software companies can create professional and effective invoices that enhance customer satisfaction, improve cash flow, and strengthen business relationships.

In the concluding section, we will delve into strategies for optimizing invoice processes further, exploring advanced techniques and industry-specific considerations to maximize efficiency and drive business growth.

Conclusion

In conclusion, this article has explored the nuances of “invoice format in word for software company”, emphasizing its significance in ensuring accurate billing, efficient processes, and positive customer relationships. We have highlighted key elements such as company and customer information, itemized services, payment terms, and notes, emphasizing their role in creating clear and compliant invoices.

To optimize invoice processes, software companies should focus on automation, accuracy, and customer service. Automation tools streamline invoice generation, improve efficiency, and reduce errors. Accuracy ensures timely payments and minimizes disputes, while excellent customer service fosters positive relationships and builds trust. By implementing these strategies, software companies can leverage invoice formats to enhance their billing practices, drive growth, and maintain strong financial controls.