An invoice is a legal and commercial document that itemizes transactions between a buyer and seller, and it serves as a request for payment. It records the products or services provided, their quantities, and prices, along with the payment terms and contact details of both parties.

Invoices are essential for businesses to manage cash flow, track expenses, and ensure accurate accounting. They provide a clear record of transactions and facilitate efficient communication between buyers and sellers. The standardization of invoices has been a key historical development, enabling seamless international trade.

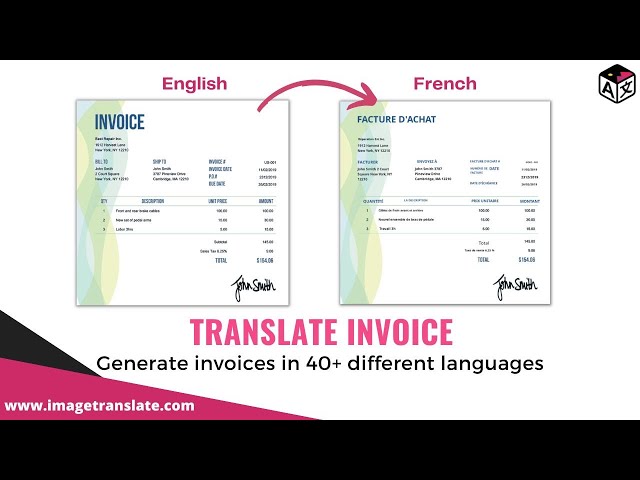

Understanding the meaning of “invoice” in different languages is crucial for global business operations, fostering communication and facilitating cross-border transactions. This article explores the variations in invoice terminology across major languages, providing insights for effective communication in international commerce.

Invoice Meaning in Different Languages

Understanding the diverse meanings of “invoice” across languages is crucial for facilitating international trade and fostering clear communication between businesses.

- Terminology

- Phrases

- Structure

- Legal implications

- Cultural nuances

- Translation accuracy

- Regional variations

- Historical context

- Industry-specific terms

- Digital formats

These aspects influence the precise meaning and interpretation of invoices in different languages. For instance, legal implications vary across jurisdictions, affecting the enforceability and validity of invoices. Cultural nuances can shape the language used and the overall tone of invoices. Understanding these aspects enables businesses to create invoices that are clear, compliant, and effective in cross-border transactions.

Terminology

Terminology is the foundation for understanding the meaning of “invoice” across different languages. Variations in terminology can lead to confusion and misinterpretations in international business transactions.

-

Core Terms

The core terms used to describe an invoice, such as “invoice,” “bill,” and “statement,” may vary across languages. Understanding these core terms is essential for identifying and interpreting invoices.

-

Invoice Components

The specific components included in an invoice, such as the invoice number, date, payment terms, and itemized list of goods or services, may vary depending on the language and cultural norms.

-

Legal Language

The legal language used in invoices can have significant implications for the enforceability and validity of the invoice. Terms such as “warranty” and “disclaimer” may have different interpretations in different languages.

-

Cultural Nuances

Cultural nuances can influence the language and tone used in invoices. For example, some languages may use more formal and polite language, while others may use more direct and concise language.

Understanding the terminology associated with “invoice meaning in different languages” is crucial for effective cross-border communication. By being aware of the variations in core terms, invoice components, legal language, and cultural nuances, businesses can create and interpret invoices that are clear, compliant, and effective.

Phrases

Phrases play a critical role in conveying the meaning of invoices in different languages. They provide specific, contextualized information that clarifies the purpose and intent of the invoice. Understanding these phrases is essential for accurate interpretation and effective communication in international business transactions.

For instance, the phrase “payment terms” indicates the conditions under which payment is expected, such as the due date and any discounts or penalties. This phrase can vary across languages, affecting the interpretation of the invoice and the buyer’s understanding of their payment obligations.

Another important phrase is “itemized list of goods or services.” This phrase describes the specific goods or services being invoiced, along with their quantities, prices, and any applicable taxes or fees. The clarity and accuracy of this phrase are crucial for ensuring that both the buyer and seller have a clear understanding of the transaction.

In practice, understanding the phrases used in invoices in different languages enables businesses to avoid misunderstandings, disputes, and delays in payment. By being aware of the variations in phrases and their implications, businesses can create and interpret invoices that are clear, compliant, and effective in cross-border transactions.

Structure

The structure of an invoice plays a pivotal role in conveying its meaning across different languages. A well-organized and consistent structure ensures that essential information is presented clearly and enables both the sender and recipient to easily understand the invoice’s content.

The structure of an invoice typically includes specific sections, such as the invoice number, date, sender and recipient information, itemized list of goods or services, payment terms, and any applicable taxes or fees. Each section serves a specific purpose and is organized in a logical flow to facilitate efficient processing and interpretation.

For example, the invoice number is crucial for identifying and tracking the invoice, while the payment terms clearly outline the expected payment date and any applicable discounts or penalties. The itemized list of goods or services provides a detailed breakdown of the transaction, ensuring that both parties have a clear understanding of the goods or services provided and their associated costs.

Understanding the structure of invoices in different languages is essential for effective communication in international business transactions. By adhering to standardized structures, businesses can create invoices that are easily comprehensible, reducing the risk of errors, disputes, and delays in payment. Moreover, a consistent structure facilitates the automation of invoice processing, enhancing efficiency and reducing the potential for human error.

Legal implications

Legal implications play a critical role in shaping the meaning and significance of invoices in different languages. Invoices serve as legally binding documents that outline the terms and conditions of a transaction between two parties. Therefore, the legal implications associated with invoices vary depending on the applicable laws and regulations of the jurisdictions involved.

One crucial aspect of legal implications is the enforceability of invoices. The validity and enforceability of an invoice are determined by the governing laws of the relevant jurisdiction. For instance, certain terms and conditions included in an invoice may not be legally enforceable in a particular country, which can impact the rights and obligations of the parties involved.

Understanding the legal implications of invoices in different languages is essential for businesses operating in a globalized marketplace. By being aware of the legal requirements and potential consequences, businesses can create and interpret invoices that are legally compliant and protect their interests.

In summary, legal implications are an integral component of invoice meaning in different languages. They define the legal rights and obligations of the parties involved, ensuring that invoices are legally enforceable and compliant with the applicable laws and regulations.

Cultural nuances

Cultural nuances play a significant role in shaping the meaning and interpretation of invoices in different languages. Cultural norms, values, and communication styles can influence the language, tone, and specific terms used in invoices, affecting their overall meaning and effectiveness.

For example, in some cultures, invoices may use formal and polite language, with a focus on building relationships and maintaining harmony. In contrast, other cultures may adopt a more direct and concise approach, prioritizing efficiency and clarity. These cultural differences can impact the way invoices are perceived and interpreted, potentially leading to misunderstandings or miscommunications.

Understanding cultural nuances is critical for businesses operating in a globalized marketplace. By being aware of the cultural context in which an invoice is created and interpreted, businesses can create invoices that are culturally appropriate, respectful, and effective in conveying the intended message.

Furthermore, understanding cultural nuances can help businesses avoid potential pitfalls and challenges in cross-border transactions. By tailoring invoices to the cultural norms of the recipient, businesses can increase the likelihood of timely payments, reduce disputes, and foster stronger business relationships.

Translation accuracy

Translation accuracy plays a pivotal role in ensuring the precise and effective conveyance of invoice meaning in different languages. Accurate translation is crucial because invoices serve as legal and commercial documents that outline the terms and conditions of a transaction, including the goods or services provided, quantities, prices, payment terms, and other relevant details. Any inaccuracies or errors in translation can lead to misunderstandings, disputes, and potential legal implications.

Real-life examples underscore the significance of translation accuracy in invoice meaning. Mistranslations of key terms or phrases can result in incorrect interpretations of payment terms, leading to delayed or missed payments. Errors in translating product descriptions or quantities can cause discrepancies in the goods or services received, potentially impacting customer satisfaction and business reputation. Accurate translation ensures that all parties involved have a clear understanding of the invoice’s content, minimizing the risk of disputes and facilitating smooth business transactions.

The practical applications of understanding the connection between translation accuracy and invoice meaning are far-reaching. Businesses operating in a globalized marketplace rely on accurate translations to ensure that invoices are legally compliant, culturally appropriate, and easily understandable by international clients. By investing in professional translation services, businesses can safeguard their financial interests, enhance customer satisfaction, and foster stronger cross-border relationships.

In summary, translation accuracy is an indispensable component of invoice meaning in different languages. Accurate translation ensures that invoices are clear, precise, and legally compliant, facilitating effective communication, minimizing risks, and promoting trust in international business transactions.

Regional variations

Regional variations significantly impact invoice meaning in different languages. These variations stem from diverse cultural, legal, and business practices across regions, leading to unique interpretations and requirements for invoices.

One critical aspect is the inclusion of specific information on invoices. For example, in some regions, invoices must include the seller’s tax identification number, while in others, it is optional. Additionally, the format and layout of invoices may vary, affecting the overall meaning and comprehension. Understanding these regional variations is crucial to ensure invoices are legally compliant and effectively convey the intended message.

Real-life examples abound. In the European Union, invoices must adhere to specific VAT regulations, including the display of the VAT amount and tax registration number. In contrast, invoices in the United States typically do not require VAT information but may need to include sales tax details depending on the state. Failure to consider regional variations can lead to confusion, payment delays, and potential legal consequences.

The practical applications of understanding the connection between regional variations and invoice meaning are multifaceted. Businesses operating globally must adapt their invoices to comply with different regional requirements. Accurate and compliant invoices facilitate seamless cross-border transactions, reduce the risk of errors and disputes, and enhance overall efficiency. Ignoring regional variations can hinder communication, delay payments, and damage business relationships.

Historical context

The historical context of invoice meaning in different languages plays a vital role in understanding the evolution and cultural significance of this document. This context encompasses the development of trade and commerce, the emergence of standardized practices, and the influence of technological advancements.

-

Ancient Origins

Invoices have existed for centuries, with their roots in ancient civilizations such as Mesopotamia and Egypt. These early invoices were simple records of goods exchanged, often written on clay tablets or papyrus.

-

Medieval Evolution

During the Middle Ages, the use of invoices became more widespread as trade expanded. Merchants and traders developed standardized invoice formats to facilitate transactions across different regions.

-

Industrial Revolution

The Industrial Revolution brought significant changes to invoice practices. The advent of printing presses enabled the mass production of invoices, and the development of new transportation systems facilitated the movement of goods and services, leading to a greater need for accurate and efficient invoicing.

-

Digital Age

In the modern era, technological advancements have transformed invoice processing. Electronic invoicing (e-invoicing) and digital document management systems have streamlined the creation, transmission, and storage of invoices.

Understanding the historical context of invoice meaning in different languages provides a deeper appreciation for the complexities and diversity of this essential business document. It highlights the evolving nature of trade practices, the influence of cultural and technological factors, and the ongoing importance of clear and accurate invoicing in facilitating global commerce.

Industry-specific terms

The connection between “industry-specific terms” and “invoice meaning in different languages” is significant, as industry-specific terms are crucial components of invoice meaning. These terms convey specialized knowledge and concepts that are unique to particular industries, ensuring clear communication and accurate interpretation of invoices.

The use of industry-specific terms in invoices ensures that the goods or services provided, as well as their quantities and prices, are described in a precise and unambiguous manner. This precision is especially important in complex industries with highly technical or specialized products or services. For example, in the healthcare industry, invoices may include terms such as “CPT codes” and “DRG weights,” which are essential for.

Understanding the connection between industry-specific terms and invoice meaning in different languages is critical for businesses operating in global markets. By being aware of the industry-specific terms used in different languages, businesses can create and interpret invoices that are clear, accurate, and compliant with industry standards. This understanding facilitates efficient cross-border transactions, reduces the risk of errors and disputes, and enhances overall communication.

In summary, industry-specific terms play a vital role in ensuring the precise and effective conveyance of invoice meaning in different languages. Understanding this connection is essential for businesses operating in a globalized marketplace, as it enables them to create and interpret invoices that are clear, accurate, and compliant with industry standards, facilitating seamless cross-border transactions and fostering stronger business relationships.

Digital formats

The advent of digital formats has significantly transformed the meaning and usage of invoices in different languages. Digital formats offer several advantages over traditional paper-based invoices, including increased efficiency, accuracy, and accessibility.

Digital formats have enabled the creation of standardized invoice templates that can be easily customized and translated into different languages. This standardization has streamlined the invoice creation process, reducing errors and inconsistencies. Moreover, digital formats allow for the inclusion of additional data and features, such as electronic signatures, payment reminders, and tracking information, which can enhance the efficiency and transparency of invoice processing.

Real-life examples abound. Many businesses now use electronic invoicing (e-invoicing) systems to automate the invoice creation, transmission, and payment processes. E-invoicing systems can generate invoices in multiple languages, ensuring that invoices are clear and understandable to recipients worldwide. Additionally, e-invoicing systems can integrate with other business systems, such as accounting and inventory management systems, further streamlining the invoice processing workflow.

Understanding the connection between digital formats and invoice meaning in different languages is crucial for businesses operating in a globalized marketplace. By embracing digital formats, businesses can create and process invoices that are accurate, efficient, and compliant with international standards. This understanding can help businesses reduce costs, improve communication, and enhance overall operational efficiency.

Frequently Asked Questions on Invoice Meaning in Different Languages

This FAQ section addresses common queries and misconceptions regarding invoice meaning in different languages, providing clear and concise answers to guide your understanding.

Question 1: What are the key differences in invoice terminology across languages?

Answer: Invoice terminology varies significantly, including core terms like “invoice” and “bill,” invoice components, legal language, and industry-specific terms. Understanding these differences is crucial for effective communication.

…

…

Question 6: How do digital formats impact invoice meaning in different languages?

Answer: Digital formats enable the creation of standardized invoice templates, facilitating translation and ensuring consistency. They also allow for the inclusion of additional data and features, enhancing efficiency and transparency.

Summary:

Understanding invoice meaning in different languages involves considering terminology, phrases, structure, legal implications, cultural nuances, translation accuracy, regional variations, historical context, industry-specific terms, and digital formats. By addressing these aspects, businesses can create and interpret invoices that are clear, accurate, and compliant, fostering seamless cross-border transactions and stronger business relationships.

Transition:

To further explore the practical implications of invoice meaning in different languages, let’s delve into real-world examples and best practices for effective communication in international business.

TIPS FOR EFFECTIVE INVOICE COMMUNICATION IN DIFFERENT LANGUAGES

To ensure clear and accurate invoice communication in different languages, consider these practical tips:

Tip 1: Use Clear and Concise Language: Employ simple and direct language to convey the invoice details, avoiding jargon or ambiguous terms.

Tip 2: Pay Attention to Cultural Nuances: Be mindful of cultural differences in invoice formats, phrases, and payment expectations.

Tip 3: Ensure Accurate Translation: Engage professional translation services to ensure precise and culturally appropriate invoice translations.

Tip 4: Standardize Invoice Formats: Establish consistent invoice templates and structures that are easily understandable across languages.

Tip 5: Include Essential Legal Information: Clearly display all necessary legal information, such as tax identification numbers and payment terms, in compliance with local regulations.

Tip 6: Use Digital Formats: Leverage digital invoicing tools to streamline invoice creation, translation, and processing, reducing errors and improving efficiency.

Tip 7: Provide Multi-Language Support: Offer invoice translations in multiple languages to cater to diverse customer bases and enhance communication.

By implementing these tips, businesses can improve the clarity, accuracy, and effectiveness of their invoice communication in different languages, fostering stronger business relationships and facilitating seamless cross-border transactions.

In the concluding section, we will explore best practices for cross-cultural invoice communication, highlighting strategies for building trust, resolving disputes, and maintaining positive business relationships in a globalized marketplace.

Conclusion

Understanding invoice meaning in different languages is paramount for effective international business communication. This article has explored various aspects of invoice terminology, including phrases, structure, legal implications, cultural nuances, translation accuracy, regional variations, historical context, industry-specific terms, and digital formats.

Key points to remember include:

- Invoice meaning varies across languages due to cultural, legal, and industry-specific factors.

- Accurate translation, attention to cultural nuances, and clear communication are essential for effective invoice comprehension.

- Digital formats and standardized templates can enhance invoice accuracy, efficiency, and cross-language consistency.

In today’s globalized marketplace, businesses must prioritize cross-cultural invoice communication to foster trust, resolve disputes, and maintain positive business relationships. Embracing the insights presented in this article empowers businesses to navigate the complexities of invoice meaning in different languages, promoting seamless international trade and collaboration.